|

I HAVE BEEN APPROVED BY THE STATE OF FLORIDA TO PRODUCE A WIND MITIGATION REPORT FOR

YOUR HOME:

SAVE UP TO 40% ON PROPERTY INSURANCE

What is a Wind Mitigation Inspection ? The

state of Florida REQUIRES Insurance Companies to offer REDUCED RATES on Wind Insurance for certain Hurricane resistant features.

I will inspect the features present on your home and produce a WIND MITIGATION inspection report for you in order to obtain

your WIND MITIGATION CREDITS from your insurance agent. Wind Mitigation Certification To qualify for a Wind Mitigation Discount

and/or rebate on your existing wind insurance policy, insurance companies require a licensed building professional certification

(Wind Mitigation Inspection)of the structure. The $120 charge will cover all related aspects of the wind mitigation inspection

and wind mitigation certification. I can also make suggestions on ways you might even increase your discount. Questions and

Answers 1) How do I know if I will qualify for a Windstorm Mitigation discount? Just schedule a WIND MITIGATION INSPECTION

by calling me at 407-892-9661. I will only check those items and construction features specifically listed on the wind mitigation

insurance inspection form (nothing else is inspected or reported to the insurance company). The entire inspection will only

take less than 30 minutes.

The state of Florida REQUIRES Insurance Companies to offer REDUCED RATES for certain Hurricane

resistant features.

Contact me.... for your one time inspection and

save money now! You will receive a refund check from your insuance company if you pay your premium in full for the entire

year. If you make your insurance payment through your mortgage payment, then your mortgage payment will be reduced accordingly

each month. You will then receive your discount every time you renew your policy each year. There are inspection fee discounts

for multiple property owners and scheduling with a neighbor...so tell a friend!

The state legislation adopted provisions for a

new statewide building code (the 2001 Florida Building Code), which became effective on March 1, 2002. The same legislation

included a requirement for insurance companies to provide property insurance discounts for homes that have construction features

that reduce the losses in windstorms. Each insurance company was required to submit new rates by February 28, 2003 and include

discounts for wind damage reduction (mitigation) construction features. The discounts are justified because stronger, more

wind-resistive houses have lower windstorm losses, and lower windstorm losses mean reduced costs to insurance companies. The

insurance discounts provide some financial incentives for homeowners to strengthen their existing homes and for new construction

to be built to the strongest options in the Florida Building Code. These new insurance rate discounts in Florida began to

take place in 2003. They apply to both existing construction (houses built prior to 2002) and new construction built to the

new statewide Florida Building Code (FBC). To qualify for these discounts, most insurance companies require a certification

of the key construction features.

Windstorm construction features protect your home from catastrophic hurricane damage

by strengthening your homes ability to withstand the uplift, shear and lateral forces of the wind associated with a hurricane

to the exterior shell of your home. The features enhance the vulnerable components of your home's protective shell or envelope

by fortifying your roof, exterior walls, windows and doors so they will not breach or fail in high winds. If this protective

shell or envelope is breached, not only can wind-driven rain and debris enter your home causing considerable damage to its

interior, but the high winds can enter your home and exert pressure on your walls and roof leading to catastrophic damage

to your property.

What qualifies for an Insurance Discount : Existing homes built

prior to 2002 that have one or more of these wind resistive construction features will qualify for significant credits.

A windstorm mitigation inspection will certify your homes existing construction features. I will provide you with a wind mitigation

certification inspection report.

1. Roof coverings, such as shingles that meet the FBC Requirements.

2. Roof

decks that have been installed with large nails and close spacing.

3. Hurricane clips/straps that hold the roof structure

to the walls.

4. Protection of Openings such as windows and glass doors with impact resistant glazing or other protection

systems.

5. Secondary Water Resistance that prevents the roof from leaking if the roof covering is blown off in a

windstorm.

6. Wall construction type such as concrete block or wood frame exterior walls

7. Gable end bracing.

8. Roof shape.

WHAT IS IT?

A Wind Mitigation inspection

is done to ensure the quality of your home to your Insurance carrier

and to qualify you for an insurance policy premium discount.

WHY

HAVE IT DONE?

Florida Statute 626.0629 requires Insurance companies to offer Florida homeowners "discounts, credits, or other rate

differentials..." for construction techniques that reduce damage and loss in windstorms. This entitles you to certain insurance

premium reductions. If you have a Windstorm insurance policy and HAVE NOT had an inspection done, I can

SAVE you money on your current policy!

WHAT IF I PAID MY PREMIUM FOR THE YEAR?

Even

if you paid your premium for the year, you are entitled to a premium reduction retroactive from the date your wind mitigation

form is approved by your insurance company.

HOW

MUCH DOES IT COST?

For a complete wind mitigation report I charge $120 send a State Certified General Contractor

to your home for just $15

HOW

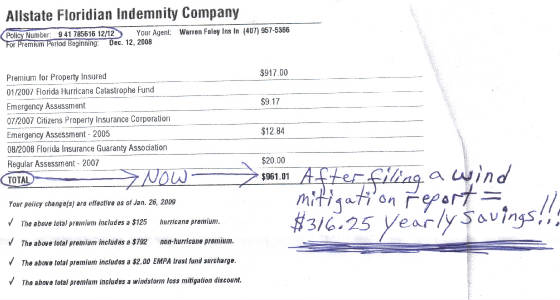

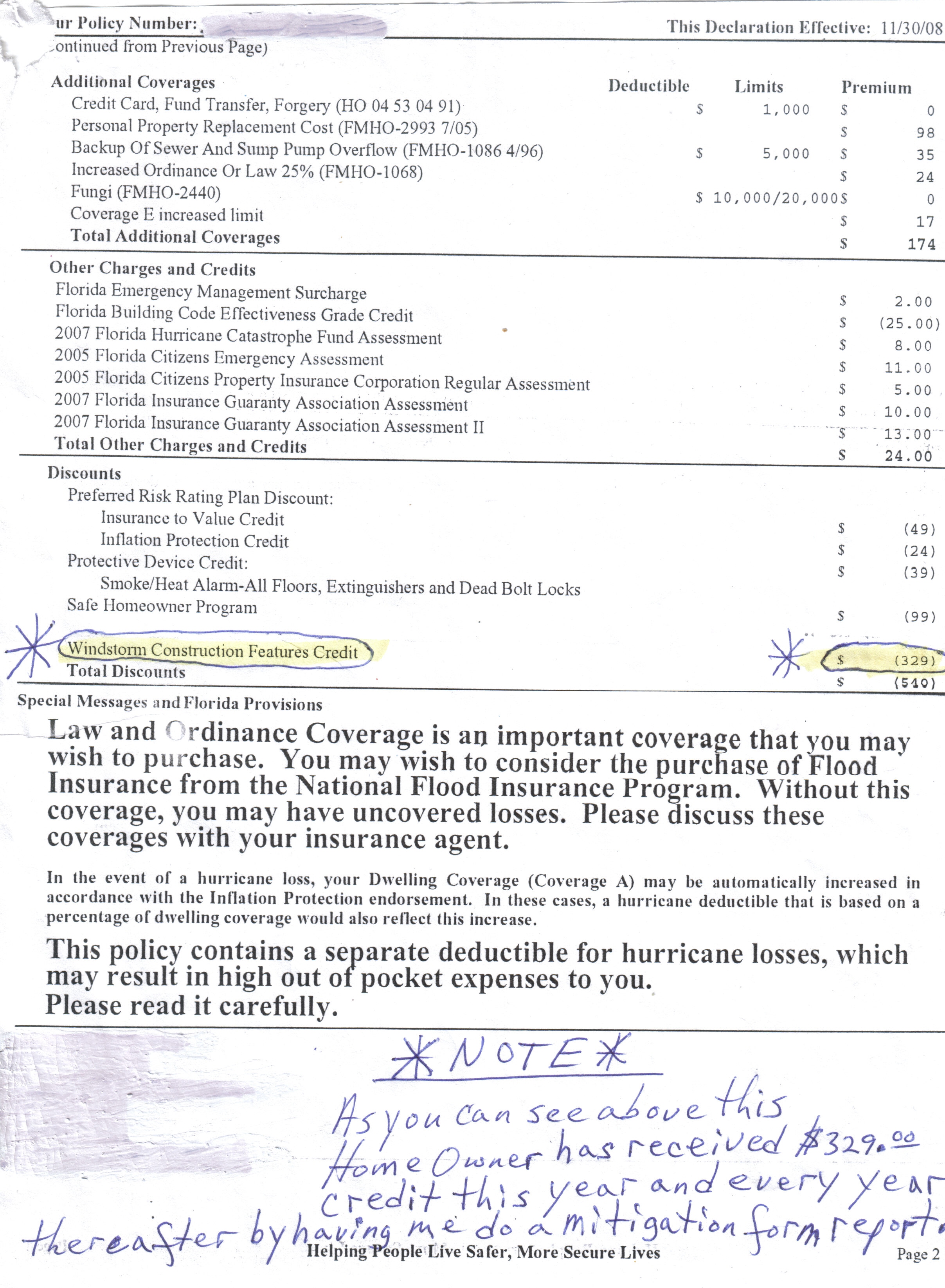

MUCH WILL I SAVE?

I have seen customers save as much as a

couple hundred dollars a year. Most people will recoupe their Inspection costs the first year and continue to receive

yearly credit. To further verify for yourself how very real this opportunity is, you may contact "Creighton" for whom I did

a report for that received over $200 in yearly credit at: 407-498-0411.

Consult Florida Statute 627.0629 Residential property insurance for more information.

______________________________________________________________

|